If you are a Pakistani citizen, you need to pay a certain amount of tax on your property as implied by the Federal Board of Revenue (FBR) Pakistan.

Property taxes in Pakistan are generally updated every year, and the amount depends mainly on whether you are buying property, selling property, or holding property, or whether you are a tax filer, non-filer, or late filer, and also upon the value of the property. Filers generally have to pay lower tax rates, whereas non-filers have to pay multiple times more tax on property, as per the government’s regulations.

This article explains all major property-related taxes in Pakistan for 2025–26, issued under the Income Tax Ordinance and Finance Act updates for this fiscal year.

Table of Contents

Checklist for Eligibility Property Taxes 2025-2026

To check your eligibility for property taxes in Pakistan, you should check your tax status, the location of your property, the total worth/value of the property, and check for exemptions, if any.

- Check Status: Are you a Filer or Non-Filer?

- Check Location: Is the property in Punjab (DC Rate system), Sindh (ARV system), or any other province in Pakistan?

- Check Value: Is the property value >250 Million?

- Check Exemptions: Are you a widow, retired government servant, or owner of a small dwelling (5 Marla/120 sq yds)?

- Are you an overseas Pakistani with a NICOP/POC?

Who is a Filer, Non-Filer, or Late Filer?

Your tax status has the single biggest impact on how much tax you pay.

- Filer: You are a File if you pay all the taxes, and your name appears on the Active Taxpayer List (ATL) of FBR

- Late Filer: You are a Late Filer if your file returns after deadlines and faces higher rates

- Non-Filer: If you have never filed an income tax return, you are a Non-Filer.

Federal vs Provincial Property Taxes: Important Difference You Must Know

Besides, Property taxes in Pakistan involve both federal and provincial taxes, which is more like who charges what. Many people incorrectly assume that all taxes are federal; however, both systems work simultaneously. So understand that:

- Federal taxes (FBR) are those property taxes that are applied when you buy, sell, or hold high-value property. These apply across Pakistan, regardless of province.

- Provincial taxes are charged annually on holding property, administered by provincial excise and taxation departments (Punjab, Sindh, KP, Balochistan).

Simple Property Tax Calculation (UPDATED)

To calculate property tax in Pakistan, you need to:

- Identify transaction type (Buy / Sell / Hold)

- Confirm filer status

- Apply relevant section (236K, 236C, CGT, or 7E)

- Use FBR valuation, not market price

- Adjust advance tax in annual return (if filer)

Are You Buying, Selling, or Holding Property?

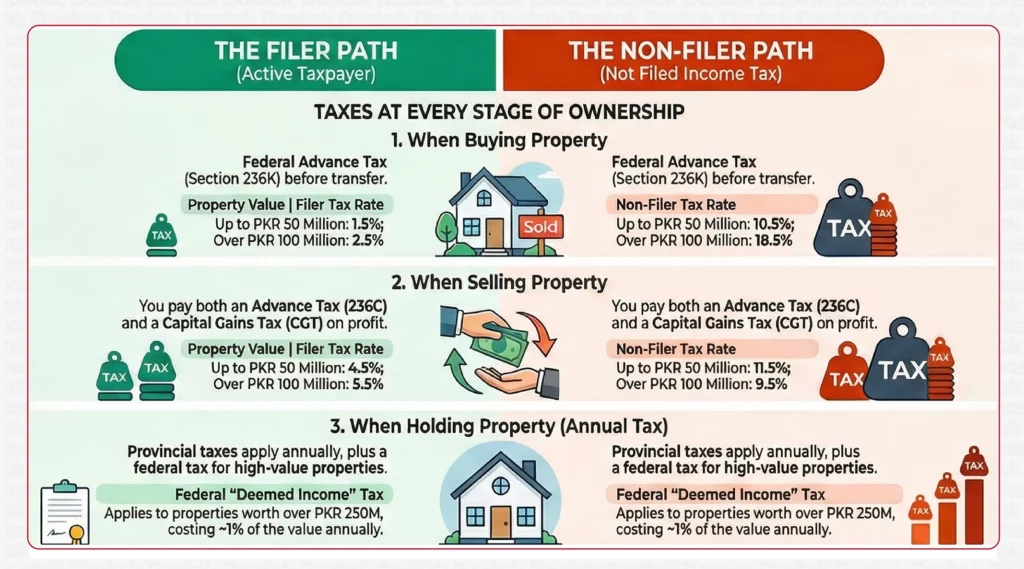

Property taxes 2025-2025 are applicable from July 1, 2025 till June 30, 2026. But before jumping into the tax rates, you need to clarify the confusion around property taxation itself. So in Pakistan, property is taxed at three different stages, often by different authorities:

- Buying property: If you are buying property, you need to pay Federal Advance Tax (Section 236K – FBR)

- Selling property: If you are selling property, you need to pay two taxes, i.e., Federal Advance Tax (Section 236C – FBR) + Capital Gains Tax.

- Holding property: If you own a property for a certain period of time, you’ll need to pay Property Holding Tax, which generally comes under provincial regulation and plus possible federal deemed income tax.

Tax on Buying Property in Pakistan: 236K

If you are buying property, you must pay this tax before the property is transferred to your name. Remember that it’s a Federal tax (FBR) and applies regardless of province or market price. The cost heavily depends on whether you are a Filer (Active Taxpayer) or a Non-Filer.

| Property Value | Filer (You pay less) | Non-Filer (You pay much more) |

|---|---|---|

| Up to 50 Million | 1.5% of value | 10.5% of value |

| 50 Million to 100 Million | 2% of value | 14.5% of value |

| Over 100 Million | 2.5% of value | 18.5% of value |

Tax on Selling Property in Pakistan: 236C

Similarly, if you are selling property, you must pay this tax when transferring the property to someone else.

| Property Value | Filer | Non-Filer |

|---|---|---|

| Up to 50 Million | 4.5% of value | 11.5% of value |

| 50 Million to 100 Million | 5% of value | 11.5% of value |

| Over 100 Million | 5.5% of value | 9.5% of value |

For all these, property taxes on filers are much less than on non-filers, so if you are a filer, your name appears on the FBR Active Tax Payers list, you don’t need to worry much.

Deemed Income Tax on Property (Section 7E)

Deemed income property tax is applied only to high-value property owners, such as a resident individual who owns property with a fair market value exceeding PKR 250 million. FBR assumes this property generates income, even if it is not rented, so you have to pay this tax on it:

- Deemed income: 5% of property value

- Tax rate: 20% on deemed income

- Effective burden: approximately 1% of property value annually

Deemed Income Tax Eligibility

This applies to all residents, but exemptions may apply to self-owned agricultural property (excluding farmhouses) or property from which tax is already paid.

Capital Gains Tax (CGT) on Property in Pakistan

Capital Gains Tax applies only on profit made from selling property, not on the total sale value of the property.

New Criteria (After 1 July 2024)

- Filers: If you are a filer, you pay a flat 15% CG tax on the profit.

- Non-Filers: Higher rates apply

- Holding period benefit removed

Old Criteria (Before 1 July 2024)

- CGT rate decreases as the holding period increases

- In many cases, 0% CGT after 4–6 years, especially for constructed property. If you bought the plot years ago, the tax might be 0% if you held it for more than 4-6 years.

- Always verify the acquisition date before calculating CGT.

Provincial Annual Property Tax (Holding Tax)

Apart from federal taxes, provinces charge an annual property tax for holding property.

- Punjab: Based on DC valuation and rental value

- Sindh: Annual Rental Value (ARV) system

- Commercial property: Always taxable

Small residential units (e.g., 3.5–5 Marla) and specific categories such as widows or retired government servants may be exempted from these taxes.

Property Tax Rules for Overseas Pakistanis (NICOP / POC Holders)

If you are an overseas Pakistani, the property taxes on you will depend on the following 3 points:

- Hold NICOP or POC

- Are a non-resident (stay in Pakistan for less than 183 days)

- Register your ID on the FBR portal

So if you have a NICOP/POC, and you have registered your ID on the FBR portal, you can pay property taxes on buying/selling at Filer Rates only, even if you are a Non-Filer.

How Can Overseas Pay Property Tax in Pakistan?

To apply, you must verify your eligibility on the Punjab Excise and Taxation Department website, prepare documents (ownership deed, CNIC, PT-1 register copy), and register yourself via the municipal portal.

How FBR Calculates Property Value? (FBR Notification 2025)

FBR values property per covered square foot using official rates. Ground floors carry full value, upper floors and basements are valued lower, and older buildings receive depreciation based on age. These values are used only for federal taxes.

Common Misconceptions About Property Tax in Pakistan

| Misconceptions | Reality |

|---|---|

| Non-filers cannot buy property | Non-filers can buy property, but they have to pay much higher tax |

| CGT applies on total sale value | CGT just applies to profit |

| Advance tax means no further tax | Adjustment may be required in return |

| Provincial property tax and FBR tax are the same | They are separate |

Final Thoughts

Property taxes in Pakistan have become organized in the past few years, but at the same time, they have become quite expensive, particularly for non-filers and high-value property owners. So one must understand which tax applies at which stage so as to avoid unnecessary costs. For complex cases, always verify calculations through the FBR portal or consult Dastak for tax guidance.